Tax File

The Tax File determines how you charge taxes. It contains the tax rates in percentages for the states, cities, and counties to which your customers are subject. Once a tax record is established, you can insert its code into the customer's Billto File record, an order, or an invoice header screen. Each customer record or order can contain up to two tax codes, representing the applicable tax rates.

In the Tax File, you'll enter the percentage and create a description of the tax; some of your customers might want to know, for example, why an extra 1½% is being charged. The description appears beside the charge on invoices. You can enter the G/L account at the same time, or enter it later. You'll also enter the appropriate options for tax on freight, other taxes, and terms discounts.

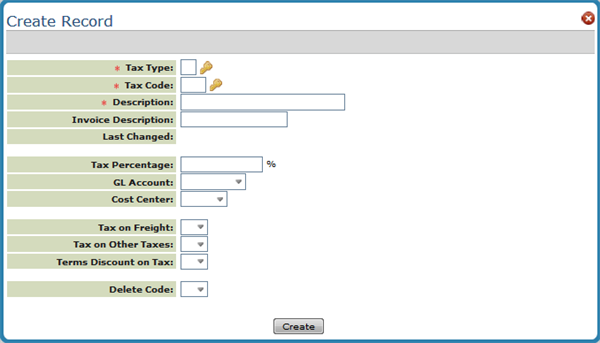

To create new Tax Records, click Records and then select Create.

| Field Name | Description/Instructions |

| Tax Type Tax Code |

The tax records you create has two settings:

For example, if the Tax Type is S, the Tax Code could be NC to represent the North Carolina State sales tax. If you are only assigning the O (other) code, make sure it is a cumulative percentage of the state, county, and city taxes. For example, if you have a simple tax structure in your state and are just reporting one number to the state, you can use either the S tax or the O tax. Enter the full tax percentage for either of them but not for both. When you assign these codes to the Customer File, if you enter both S and O tax codes, the system adds the two percentages and charges the customer the total perÂcentage of the two. If you report your sales tax by state, county, city, or even MTA codes, we recommend that you use S for the flat state tax rate. Combine the city and MTA percentages into the O tax rate. The sales tax report shows the report by state and other tax. To report your sales tax for county, city, and MTA, you manually calculate them according to the appropriate percentages. You could create just one code for the O tax rate that includes county, city, and MTA. |

| Description | Description of this tax code; for internal use; does not print on invoices. For example, you could enter New York State Tax. |

| Invoice Description |

If a description is entered, replaces the generic description that normally appears on invoices. Attention Canadian Users: GST and PST tax records should use this field, so GST or PST prints on all invoices. You should consider using this field for all tax records in your system, so that invoices show the proper description of all taxes charged. |

| Last Changed | Date on which the last changes were made to this record. You cannot change this field. |

| Tax Percentage | Percentage of sales to be applied by this tax code; shows three decimal places. |

| G/L Account | Liability general ledger account number to which this tax rate relates. |

| Cost Center | Cost center, if any, to which this tax rate should relate. Normally, this field should be left blank. The system then relates each sale to the most applicable cost center from the invoice. |

| Tax on Freight |

Enter Y if this tax is to be applied to freight charges as well as product charges. Tax on Freight is applied to freight that is entered into the Freight field on invoicing. Do not confuse this option with the Tax on Delivery Charges option which is set in the Delivery Charges File. For Canadian customers, if you need to tax GST only for freight then this field is the way to enter freight so that only GST is taxed and not PST. |

| Tax on Other Taxes | Enter Y if this tax is to be applied to other taxes. For example, if this record is an O (other tax), Y indicates to tax the state tax. If this record is an S (state tax), Y indicates to tax the other tax. |

| Terms Discount On Tax | Enter Y if terms discount should apply to the tax charged. |

| D/Del | Enter D in this field to delete this record. |

Associated Files

- Tax Audit Inquiry by Invoice Number - SYS 909 - This Special System Setting displays the breakdown of taxable versus non-taxable amounts on an invoice.

- Tax Exemptions